Invest in the land of opportunity

Your US portfolio could include household name brands like Apple and Microsoft, disruptors like Tesla and Netflix, and the tech innovators fueling the global AI revolution. Or you could seek out the small cap game-changers and be an early investor in the Amazons of tomorrow.

$0 Brokerage Fees on US Stock Trades

To celebrate the launch of US shares on our platform, we’re offering individual account holders a limited time offer: $0 brokerage fees on US stock trades. (Please note that FX fees still apply).

Ready to start trading stateside?

Buying US shares is easy. Check out the step-by-step guide and demo video, then activate your international account and start broadening your investment horizons.

To learn how to open your international trading account, watch our demo video or read our instruction manual here.

Get a piece of the action with fractional share trading

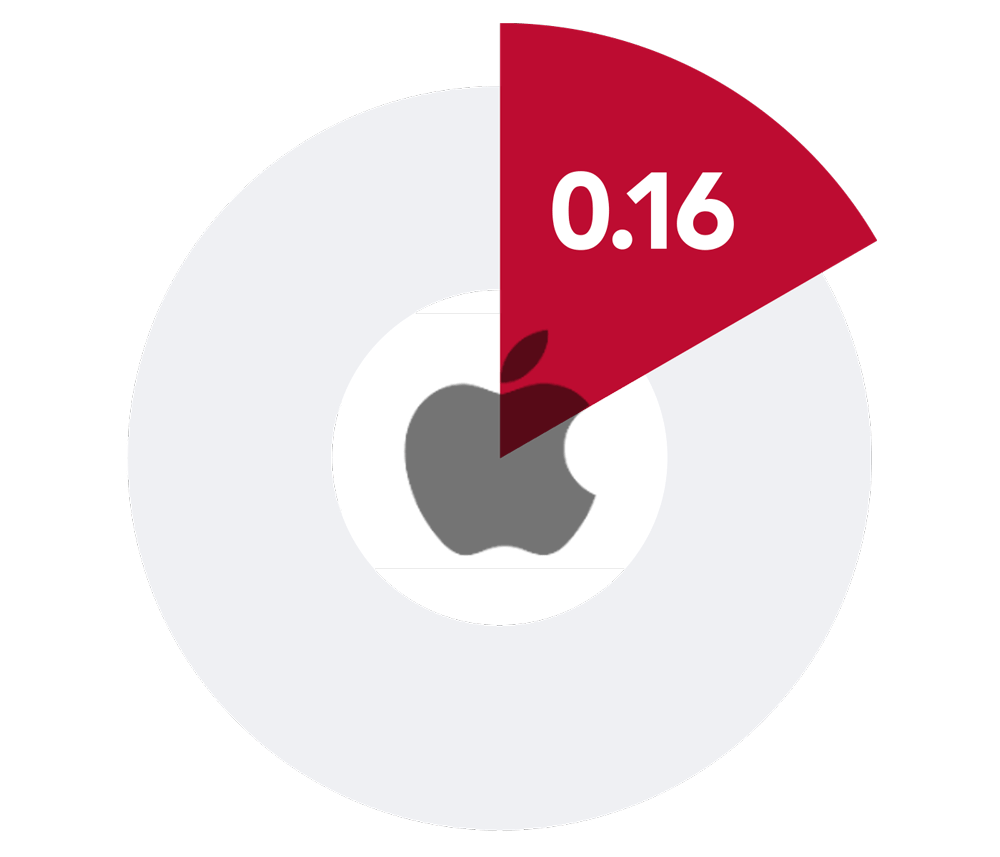

The sky-high share prices of corporate giants like Amazon, Alphabet (Google) and Berkshire Hathaway have kept them out of reach of many individual investors.

But with Bell Direct, you can now invest any amount over US$300 or more, to buy only a fraction of a share and own a small stake in the big players.

Find out more about the benefits of fractional share trading here.

I’ve got a Bell Direct account

I’m new to Bell Direct

Why US shares?

Diversification

The US sharemarket is by far the world’s biggest, offering investment opportunities unavailable in Australia, and further diversification via currency exposure.

Access to big global brands

Nine of the 10 biggest companies in the world are listed in America. US shares let you invest in the familiar brands you interact with every day.

New sector opportunities

From start-ups to global corporates, you can now access shares in US companies transforming the world in fields like technology, AI, healthcare and communications.

Higher return potential

The US sharemarket’s size, sector diversity and the growth potential of its many world-leading companies offers potential for enhanced long-term returns.

Why invest in the US with Bell Direct?

Award-winning platform

Trade US shares on the intuitive, easy-to-use platform that’s ranked #1 in overall satisfaction by experienced investors.

Convenience

All your investments on one platform means less hassle, less reporting, and less admin – plus Bell Direct’s smart tools and exclusive insights that give you an investing edge.

Access US shares with less

Bell Direct’s fractional trading service lets you get a small slice of the big US brands and spread your exposure across multiple high-price stocks.

I’ve got a Bell Direct account

I’m new to Bell Direct

What can you trade?

You can invest in the following assets listed on US exchanges:

- Equities

- Exchange traded funds (ETFs)

- Exchange traded notes (ETNs)

- Approved depository receipts (ADRs)

US trading with Bell Direct is currently available to Bell Direct individual accounts that settle via the Direct Investment Account or the Macquarie Cash Management Account. Other account types coming soon.

US Stock Trades

How do I open an international trading account?

To open an international trading account with Bell Direct, you first require a Bell Direct Australian shares trading account.

Opening your account is easy – check our the instruction guide or watch our demo video now.

Download our instruction guide (PDF) here.

Watch the demo video here:

Who can create an international trading account?

Bell Direct clients with an individual account that settle via the Direct Investment Account or the Macquarie Cash Management Account.

International trading for other account types are on the way!

My international account is pending. What do I need to do next?

Don’t worry, our partner DriveWealth must ensure they have enough details to perform their “Know Your Client” obligations. They may need some more details, so we’ll be in touch shortly to obtain whatever is outstanding (usually a copy of your passport or drivers’ license).

You have 30 days to give us the information. In the meantime, you can transfer money to USD and trade on your account. However, if you do not provide the required information within the 30 days your account will be frozen.

Who provides the international trading service?

Bell Direct has partnered with DriveWealth LLC, a US registered broker dealer, to provide the international trading service. Please review the documents in the attached DriveWealth Agreements and Disclosures.

How safe are my investments through DriveWealth?

We take your security very seriously.

DriveWealth is a member of the Securities Investor Protection Corporations (SIPC), which protects the Securities and funds in your US brokerage account with DriveWealth. Your investments are covered by SIPC up to US$500,000, including up to US$250,000 protection for cash in your account to buy securities. SIPC protection is only available in the event that DriveWealth fails. SIPC does not protect against a loss in the market value of your US Securities.

What can I trade on an international trading account?

Initially you can trade securities listed on the US exchanges including equities, exchange traded funds (ETFs), exchange traded notes (ETN) and approved depository receipts (ADR).

We plan to expand your access to other markets in the future.

Do I earn interest on my US funds?

Any of your US dollars not required for settlement are invested into the Dreyfus Treasury Securities Cash Management Fund. You will receive a monthly pro-rata dividend based on the amount and duration each month.

Your investment is in ticker code DARXX, which is the Administrative Shares Class of the Dreyfus Treasury Securities Cash Management Fund.

How do I transfer funds to USD so I can trade?

To transfer funds to USD, first create your International Trading Account and make sure you have sufficient Australian dollars in your Bell Financial Trust account. See how to deposit and withdraw funds for more details.

When your account is created, follow these 5 steps:

Step 1: Make sure you have at least the equivalent of $300USD (that is the minimum amount).

Step 2: Go to the Funds Transfer screen. There are links to the Funds transfer screen in a number of placed on the website, just look for the Transfer Currency link, or choose Funds transfer from the My account menu.

Step 3: Select the International Transfer tab. On the right hand side of the screen you can see your AUD Avail Transfer Funds and your USD Available to Trade and Withdraw.

Step 4: Make sure the Send box contains the Australian flag and AUD, and the Receive box the US flag and USD.

Enter the amount you would like to send or receive, hit the tab key, and the system will calculate the other currency based on the FX rate on the screen. Click next.

Step 5: Enter your PIN and then Confirm.

You’re ready. you will be able to trade immediately on the USD that you transferred.

How do I withdraw USD and convert to AUD?

Step 1: First, check your USD Available to Withdraw on the Order Pad, the Portfolio screen or the Transfer screen.

Step 2: Go to the Funds transfer screen.

There are links to the Funds transfer screen in a number of places on the website, just look for the Transfer Currency link, or choose Funds transfer from the My account menu.

Step 3: Select the International Transfer tab. On the right hand side of the screen you can see your AUD Avail Transfer Funds and your USD Available to Trade and Withdraw. Ensure the Send box contains the Australian flag and AUD, and the Receive box the US Flag and USD.

Step 4: Enter the amount you would like to send or receive, hit the tab key, and the system will calculate the other currency based on the FX rate on the screen. Click Next.

Step 5: Enter your PIN and then Confirm.

You’ll be able to trade immediately on the domestic market. Funds will usually be available to withdraw to your nominated external bank account within one business day.

How do I place an order?

You can place an order on the same screen as the domestic market. Either click on the trade icon on the left hand side of the screen or the buy and sell buttons you see on your portfolio or the quote page.

For a buy order check on the right hand side of the screen -US Available Funds, Available to trade that you have sufficient funds to place your order.

For a sell order, the number of units you have available to sell will default into the Quantity field.

Unlike many other brokers, you can purchase fractions of international shares with Bell Direct. Enter the the amount you wish to invest in the Value field, click Market and then Next. You will see an estimate of the number of shares, including fractions, that you will purchase. (This is an estimate only based on the last available price. It may change, especially if placing your order out of the market hours).

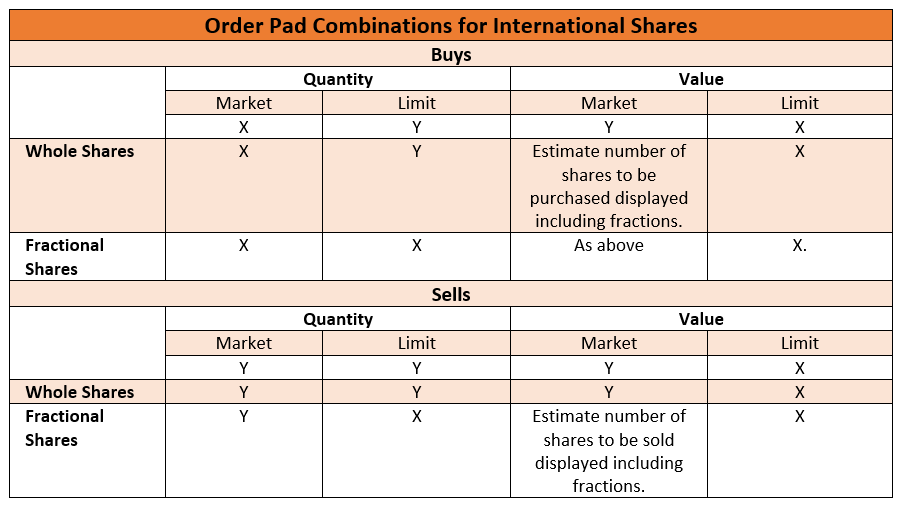

Check out the various combinations that apply for international trading on the order pad.

What are the minimum trade and transfer amounts?

The minimum amount you can transfer from AUD to USD is the equivalent of $300USD.

The minimum buy amount on any international share trade is $300USD.

What is the FX Rate?

The FX (foreign exchange) rate is displayed at the top of each screen. You will see an AUD to USD rate, and a USD to AUD rate. On the fund transfer screen you will also see the applicable rate for your transaction which will match the rates at the top of each screen.

Bell Direct takes a margin of 60 basis points on any FX transaction. For example, if you transfer $10,000 AUD to USD our margin will be $60USD, or if you transfer the equivalent of $10,000 AUD from USD then the margin will also be $60USD. This rate is highly competitive with other similar brokers.

How much is brokerage?

Trade $0 brokerage on all US trades. Note GST is not applied to international brokerage.

Are US prices delayed or real time?

All prices are in real time. Click to refresh the prices if you want the latest prices.

Where is my US tax documentation (W8BEN)?

If you would like a copy of your W8BEN or W9BEN then please contact us on 1300 786 199 or support@belldirect.com.au

How do I transfer shares into my international account?

If you have existing holdings with another broker that you would like to transfer to Bell Direct, please fill in the Transfer of Holdings form. You can find this form in your Bell Direct account under ‘My Account’ and then ‘Forms’. Under ‘International Forms’, click on ‘Transfer of Holdings’.

Kindly fill in the form and email it to us. The Delivering Firm DTC/ACAT Clearing Number can be obtained from the delivering broker.

How do I cancel, view or amend an order?

The process to view and cancel an order is the same as the domestic market.

Navigate to the Order tab at the top of the page, select Orders and scroll down to International Open Orders. Click on the cancel or view icons displayed under Details.

To cancel enter your PIN and confirm.

It is not possible to amend an International order. If you want to change it, cancel the order and place it again with the amended values.

Why is it international trading if it is only US shares?

We’re starting with US shares, with plans to add other markets down the track as demand increases. Our research shows that US markets make up the majority of what investors want and currently trade in Australia.

I was notified via email for a corporate action

You will be notified by email of any corporate action that you need to respond to. Simply follow the instructions in the email.