I’M READY

I’M THINKING ABOUT IT

How do I open a trading account to start trading?

If you already have an account with Bell Direct, simply log in and apply to open an additional trading account (including an individual, superannuation, trust, corporation or minor account).

We make switching your holdings easy and safe – as part of the application we will ask for your HIN and then we will do the switching for you. When your Bell Direct account is opened, your portfolio will be switched into your account ready to go.

What you will need to switch to a Bell Direct trading account

- Personal details for all applicants — date of birth, Australian residential address, contact address, etc.

- Company or trust documents if you are opening an SMSF, company or trust trading account

- A valid email address to receive your application details and notifications

- A current mobile number

- A current Australian bank account or margin loan account

- Tax File Number (optional)

- HIN number (optional)

How do I deposit and withdraw funds?

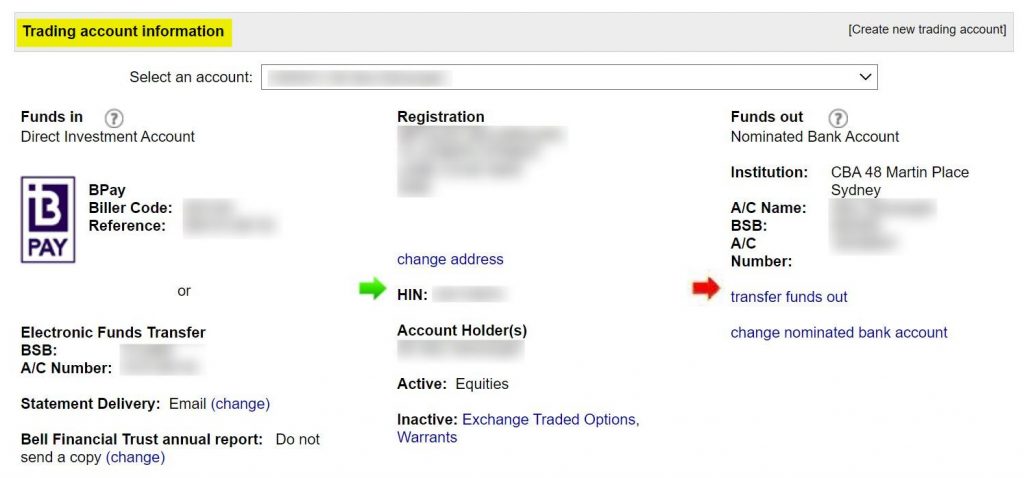

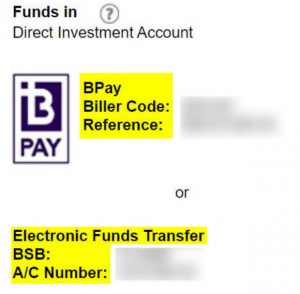

You can deposit funds into your Direct Investment Account electronically by either:

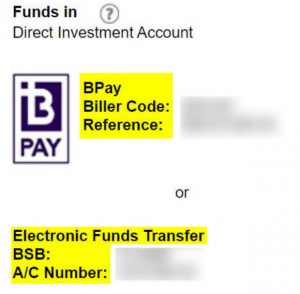

BPay: simply use the Biller Code and your BPay Reference

Electronic transfer: use your BSB and Account Number

To find your deposit details:

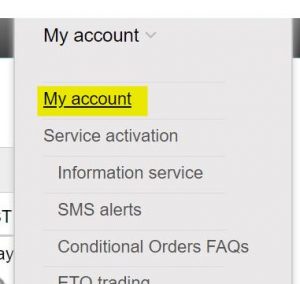

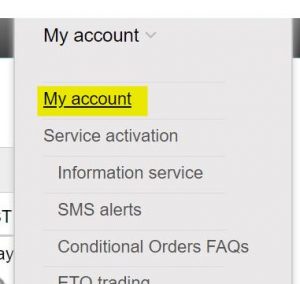

- Click on the “My account” tab underneath the “My account” drop down button (this will be in the top right of your page)

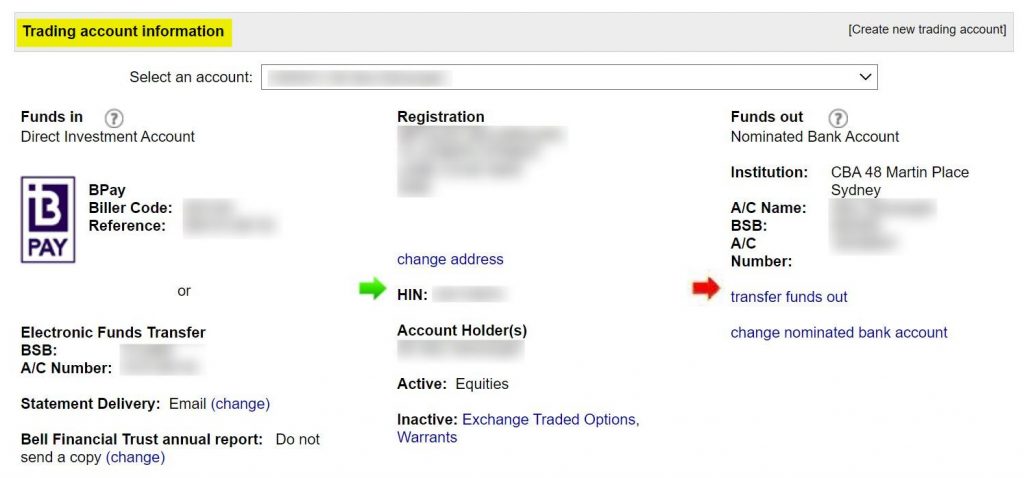

- Scroll down to the bottom of the page and you will see your ‘Trading account Information’.

- On the left hand side you can view the BPay Biller Code and Reference number as well as the BSB and Account Number for the Electronic Funds Transfer.

- Use either of these and you will be able to fund your Direct Investment Account.

Kindly note: You must first deposit funds into your trading account before you can start trading.

The timing of your funds deposit reaching your Direct Investment Account is dependent on your bank’s processing time.

If your deposit instruction was completed before your bank’s cut-off time, your funds will normally be in your Direct Investment Account the next business day. If your deposit instruction was completed after your bank’s cut-off time, your funds will normally be in your Direct Investment Account the following business day

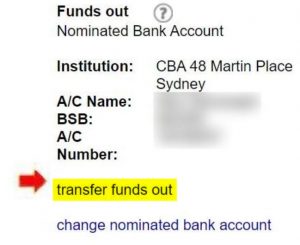

To withdraw funds you simply:

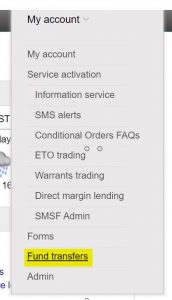

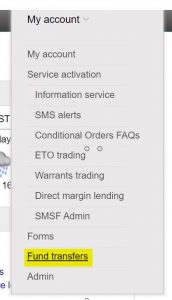

- Click on the “Fund transfers” tab underneath the “My account” drop down button (this will be in the top right of your page)

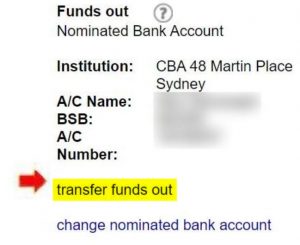

- Or, within your trading account information (under “My account” in step 1 of finding your deposit details), you can click on “transfer funds out”.

- Then, just follow the steps, and you will be able to submit a funds transfer request online at anytime from your Direct Investment Account to your nominated bank account.

- Please enter your trading PIN to complete the fund transfer request.

Your available transfer balance takes into account your cash balance and any buys pending settlement and open buy orders you have at the time of processing your transfer request. If you have sell orders that are due for settlement, you will only be able to transfer the funds out after the sell orders settle (T+2, between 12pm to 5pm AEST).

When you submit your transfer request before 2:30pm AEDT on business days, your funds transfer is processed on the same day and the funds should be in your nominated bank account the next working day.

After 2:30pm AEDT on a business day or on a non-business day, your instruction will be processed at 2:30pm the next business day.

Please note that the cut-off on non-settlement days and shortened ASX trading days such as Christmas Eve and New Year’s Eve is 12.30pm AEDT.

How do I transfer shares to Bell Direct?

To transfer shares to your Bell Direct account, follow these steps:

1. Determine where the shares are held: at another broker or at a share registry.

2. Fill up the right transfer request form:

For shares from another broker: once logged in, go to Forms in the My Account tab and fill up the Broker to Broker Transfer Request form.

Your details at the other broker must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, you will need to complete an Off Market Transfer Request form (found in Forms in the My Account tab once logged in) (at a cost of $55 per holding).

For shares from a share registry: once logged in, go to Forms in the My Account tab and fill up the Issuer Sponsored Conversion Request form.

Your details at the share registry must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, you will need to contact the share registry to change the details before submitting the Issuer Sponsored Conversion Request form.

All the request forms can be found on My account tab once you have logged in.

If you are in the process of opening a new account with us, you will have the option to transfer a HIN across during the online account setup process.

3. Send us your signed request form by:

Email at support@belldirect.com.au

Mail to Bell Direct, GPO Box 1630, Sydney NSW 2001

Once we’ve received it we’ll transfer the shares into your Bell Direct account within 3 days.

You can also watch our tutorial video:

How do I get a new Password or PIN and/or unlock my account?

New password

You may reset your Password on the ‘Sign in’ box by clicking on “reset password”.

Then type in your email address, click the “Reset” button and we will email a new password to you.

If your account has been locked, please call us on 1300 786 199 and we will assist with unlocking your account.

New PIN

If you need a new PIN, please contact us on 1300 786 199.

How do I change my details?

To change your:

- Contact details – email, mobile/phone/work/fax numbers and preferred method of contact: update them directly on My Account tab after login to your account

- Residential and postal address: login to your account and click on Forms in My Account tab to fill the ‘Change of Address’ form

Please ensure that you keep all your details up to date and feel free to contact us if you require any assistance updating them. You can reach us at on 1300 786 199 or support@belldirect.com.au.

How do I open a trading account to start trading?

If you already have an account with Bell Direct, simply log in and apply to open an additional trading account (including an individual, superannuation, trust, corporation or minor account).

We make switching your holdings easy and safe – as part of the application we will ask for your HIN and then we will do the switching for you. When your Bell Direct account is opened, your portfolio will be switched into your account ready to go.

What you will need to switch to a Bell Direct trading account

- Personal details for all applicants — date of birth, Australian residential address, contact address, etc.

- Company or trust documents if you are opening an SMSF, company or trust trading account

- A valid email address to receive your application details and notifications

- A current mobile number

- A current Australian bank account or margin loan account

- Tax File Number (optional)

- HIN number (optional)

How do I get a new Password or PIN and/or unlock my account?

New password

You may reset your Password on the ‘Sign in’ box by clicking on “reset password”.

Then type in your email address, click the “Reset” button and we will email a new password to you.

If your account has been locked, please call us on 1300 786 199 and we will assist with unlocking your account.

New PIN

If you need a new PIN, please contact us on 1300 786 199.

How do I change my details?

To change your:

- Contact details – email, mobile/phone/work/fax numbers and preferred method of contact: update them directly on My Account tab after login to your account

- Residential and postal address: login to your account and click on Forms in My Account tab to fill the ‘Change of Address’ form

Please ensure that you keep all your details up to date and feel free to contact us if you require any assistance updating them. You can reach us at on 1300 786 199 or support@belldirect.com.au.

How can I add or revoke an authorised representative on account?

To add an authorised representative to enquire or trade on your account, you will need to log into your account, go to Forms in the My Account tab and fill up the Adding Authorised Representative form.

- If the authorised representatives are an existing Bell Direct client, you can nominate their existing username on the form.

- If the authorised representatives are not an existing client, they will need to Register for a Username and once done, you can nominate their newly created username on the form.

Please note: you must provide identification for the authorised representative, such as a driver’s license or passport unless they are an existing client of Bell Direct.

Once added, authorised representatives on your account will use their own login details and will be ready to trade.

Authorised representatives are unable to:

- Suspend or close the account

- Prohibit account holders from trading

- Request stock transfers and conversions

- Request funds transfer into or out of the trading account

- Change registration details and the nominated bank account for the trading account

To revoke an authorised representative, you must provide us with written permission from all of the account holders.

How do I change my information service level?

You can upgrade or downgrade your information service level to choose between the Silver, Gold, Platinum and Iress ViewPoint levels.

To change your information service subscription, login to your account at the top of the page, go to My account tab and click on Information Service.

A window will open where you can select your new subscription.

How do I transfer shares to Bell Direct?

To transfer shares to your Bell Direct account, follow these steps:

1. Determine where the shares are held: at another broker or at a share registry.

2. Fill up the right transfer request form:

For shares from another broker: once logged in, go to Forms in the My Account tab and fill up the Broker to Broker Transfer Request form.

Your details at the other broker must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, you will need to complete an Off Market Transfer Request form (found in Forms in the My Account tab once logged in) (at a cost of $55 per holding).

For shares from a share registry: once logged in, go to Forms in the My Account tab and fill up the Issuer Sponsored Conversion Request form.

Your details at the share registry must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, you will need to contact the share registry to change the details before submitting the Issuer Sponsored Conversion Request form.

All the request forms can be found on My account tab once you have logged in.

If you are in the process of opening a new account with us, you will have the option to transfer a HIN across during the online account setup process.

3. Send us your signed request form by:

Email at support@belldirect.com.au

Mail to Bell Direct, GPO Box 1630, Sydney NSW 2001

Once we’ve received it we’ll transfer the shares into your Bell Direct account within 3 days.

You can also watch our tutorial video:

How to I transfer shares that I own to someone else?

You will need to complete and submit an Off Market Transfer Request form (once logged in, go to Forms in the My Account tab) to change the shares you own from one name into another. The fee charged is $55 per holding.

How do I update my instructions for dividends?

You can opt-in to have your dividends centralised to your Direct Investment Account via our Auto-Update function. We will automatically update the share registry with your bank account and TFN details whenever you buy new shares. Come tax time, your reporting will be even easier. You can opt in and find out more here.

How do I place an order?

You can place an order at any time over the internet or over the phone from 8am to 7pm AEST on any trading day.

To place an order via Bell Direct website, you will need:

- the ASX code of the company you wish to trade (which you can find on the quick link Quote icon)

- the quantity or value of shares you wish to buy or sell

- the price (either ‘limit’ or ‘market to limit’ price) you wish to pay for the shares

- the validity of your order (either ‘day only’, ‘good till cancelled’ or ‘specified expiry date’)

- your PIN

You can then enter an order on the order pad by clicking on the quick link ‘Trade’ icon.

To place an order over the phone, please call us on 1300 786 199.

You can also watch our tutorial video:

Buy orders can only be placed if you have sufficient cleared funds in your Direct Investment Account.

You can place orders online up to the value of $250,000.

If you want to place an order above $250,000 just call our Customer Service team on 1300 786 199 (there is no limit on the maximum value of shares for phone orders).

Alternatively, you can split the order into smaller orders and place them online.

Please note that ‘market to limit’ orders can only be placed during market opening hours which are 10am to 4pm AEST.

‘Limit’ orders can be placed at any time, but can only be executed when the market is open.

If you place an order outside the opening hours of the ASX, your order will go into a queue of orders to be placed on the market.

An order will remain on the market until it trades, expires or is cancelled by either you or the ASX.

Is there a minimum number of shares I need to buy?

If you do not have an existing shareholding in the security, the minimum marketable parcel you need to buy is $500 worth of shares, excluding brokerage.

You can then subsequently increase your holding by purchasing less than $500 worth of shares.

How do I view, amend or cancel an order?

To view an order on our website:

- You can check your order status by clicking on the Orders section

- You can also elect to receive trade confirmation by email

To amend your order on our website:

- Choose the order you wish to amend in the ‘Open orders’ section of the ‘Orders‘ page

- Make the required change (e.g. quantity, price or order validity)

To amend only the price of a partially-filled order, leave the quantity unchanged. Our platform is able to recognise any partially-filled amounts and amend only the amount that is still unfilled in the market.

To cancel an outstanding order on the website:

- Choose the order you wish to cancel in the ‘Open orders’ section of the ‘Orders‘ page

- Select ‘Cancel’

Alternatively, you can call the Customer Service team on 1300 786 199.

There are no extra charges to amend or cancel orders.

You can also watch our tutorial video:

How do I deposit and withdraw funds?

You can deposit funds into your Direct Investment Account electronically by either:

BPay: simply use the Biller Code and your BPay Reference

Electronic transfer: use your BSB and Account Number

To find your deposit details:

- Click on the “My account” tab underneath the “My account” drop down button (this will be in the top right of your page)

- Scroll down to the bottom of the page and you will see your ‘Trading account Information’.

- On the left hand side you can view the BPay Biller Code and Reference number as well as the BSB and Account Number for the Electronic Funds Transfer.

- Use either of these and you will be able to fund your Direct Investment Account.

Kindly note: You must first deposit funds into your trading account before you can start trading.

The timing of your funds deposit reaching your Direct Investment Account is dependent on your bank’s processing time.

If your deposit instruction was completed before your bank’s cut-off time, your funds will normally be in your Direct Investment Account the next business day. If your deposit instruction was completed after your bank’s cut-off time, your funds will normally be in your Direct Investment Account the following business day

To withdraw funds you simply:

- Click on the “Fund transfers” tab underneath the “My account” drop down button (this will be in the top right of your page)

- Or, within your trading account information (under “My account” in step 1 of finding your deposit details), you can click on “transfer funds out”.

- Then, just follow the steps, and you will be able to submit a funds transfer request online at anytime from your Direct Investment Account to your nominated bank account.

- Please enter your trading PIN to complete the fund transfer request.

Your available transfer balance takes into account your cash balance and any buys pending settlement and open buy orders you have at the time of processing your transfer request. If you have sell orders that are due for settlement, you will only be able to transfer the funds out after the sell orders settle (T+2, between 12pm to 5pm AEST).

When you submit your transfer request before 2:30pm AEDT on business days, your funds transfer is processed on the same day and the funds should be in your nominated bank account the next working day.

After 2:30pm AEDT on a business day or on a non-business day, your instruction will be processed at 2:30pm the next business day.

Please note that the cut-off on non-settlement days and shortened ASX trading days such as Christmas Eve and New Year’s Eve is 12.30pm AEDT.

How do I view my current balance and past transactions?

When you login to your account, you can view your current cash balance and a detailed summary of your transactions on the Portfolio page in the Portfolio & Reporting tab.

How long do settlements take?

Equity transactions on the ASX generally settle on T+2 (i.e. two trading days after the trade has taken place), although some securities may settle on a deferred basis.

Payment for share purchase will be directly debited from your Direct Investment Account.

The net proceeds from the sell trade will be deposited directly into your Direct Investment Account on the settlement date (T+2) and the funds will remain in your Direct Investment Account earning interest until you either buy more shares, or withdraw the funds.

When can I start using the proceeds from the sale of my shares to place buy orders?

You can place a buy order with funds from the sale proceeds of your shares as soon as the sell trade has been booked to your order.

Buy orders can only be placed if you have sufficient cleared funds in your Direct Investment Account as stocks cannot be used as collateral.

However, you can sell shares and use the sale proceeds to buy shares immediately after the transaction has been completed on the market.

Sale proceeds must have settled before they can be made available for any purposes other than trading.

How do I invest in managed funds through the mFund service?

Investing in managed funds with mFunds is similar to investing in equities. Simply place an order online through our Managed Funds order pad. No need to provide any additional paperwork. Funds will settle through your existing Direct Investment Account.

To invest, follow these 3 steps:

- Login to your account and research mFund products from the Managed Funds page, read the fund profile and the PDS.

- When you’re ready to invest, choose the ‘Managed Funds’ option on the Order Pad and place your order online.

- Your new mFund units are transferred to your CHESS holdings and you’ll see them in your portfolio.

To sell your managed funds units, go to the Managed Funds order pad, choose the ‘Sell’ option and enter how much quantity you plan to sell.

You can also watch our tutorial video:

What is the 1 second placement guarantee?

When you place an eligible ‘market to limit’ order, we guarantee to place it onto the ASX in under 1 second. If not, you pay zero brokerage on that trade.

The orders eligible are:

- New ‘market to limit’ orders (i.e. orders to buy or sell at the current market price at the time the order is placed)

- Order in relation to CHESS-sponsored equities, interest rate securities, warrants or exchange traded options

- Orders which meet our ASX obligations

- Orders placed via our website, WebIress or the Smartphone App

- Orders received during ASX market trading hours

‘Limit’ orders are excluded.

What is a conditional order?

Conditional orders allow you to pre-set a trade based on triggers you decide without having to consistently monitor the market. You can plan for future market conditions, capitalise on potential trading opportunities and manage downside risk by taking action in real time to manage your portfolio.

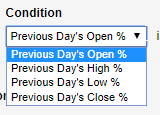

All you have to do is set specific conditions on when to buy or sell a share, and when these conditions are met, your order is triggered and sent to market. You can set a condition based on:

- a price – your pre-determined action (buy or sell) will automatically trigger when the share reaches your price.

- a percentage increase or decrease – if the stock goes beyond your specified percentage limit (based on the previous day’s open/close/high/low price), action will be triggered.

You can set trigger conditions on equities, interest rate securities, warrants and on a different stock to the one you wish to trade.

You can set a maximum of three conditional orders per stock, up to a total of 50 active conditional orders per trading account and a total of 100 active conditional orders per username across all associated trading accounts.

Our conditional order service is free and you will only pay normal brokerage when your trades are triggered and executed.

Setting trigger conditions: the limit price

Limit price

The stock must meet the price you set before your pre-determined action is triggered.

In the case of a price limit, the condition will automatically be the last traded price.

- If you are using conditional order as a stop loss, select ‘less than or equal to‘ when selling

- If you are using conditional order as a profit trigger, select ‘greater than or equal to‘ when selling

Example:

1. You have bought a stock XYZ at $10.00 and want to sell to limit your loss if the stock price begins to fall.

2. You create a conditional order by setting your trigger price to $9.70, with a sell limit at ‘less than or equal’ to $9.50.

3. If the price of XYZ reaches $9.70, your order is triggered and will be placed on the market to sell at no less than $9.50, capping your loss at $0.50 per share.

Setting trigger conditions: the trailing percentage price

Trailing percentage price

You can create a conditional order where the trigger price is based on a specific percentage movement in the share price to the previous day’s open/high/low/close price. The percentage specified must be numerical, positive and be a whole percentage number.

This trigger price is calculated, then used as a reference point to monitor trade events in the market. Action will be triggered when the stock moves above or below your calculated trigger price.

Trailing Stop Loss orders are particularly helpful for you to capture the upside in your investment but be protected from any sharp downturn in price.

| Conditional order type | When the share price rises | When the share price falls |

|---|---|---|

| Profit trigger | The trigger price remains the same | The trigger price is adjusted |

| Stop loss | The trigger price is adjusted | The trigger price remains the same |

Example: Trailing Stop Loss

Our trailing stop loss type conditional order follows a stock share price as it moves upwards, and will result in a Sell order being placed to market when the price falls and reaches the calculated trigger price.

Our trailing stop loss type conditional order is set as a trailing percentage of the previous day’s yesterday’s high/low/open/close. The trigger price is recalculated daily and will follow the share price only if it moves up. If the share price falls, the trigger price will be retained.

1. You set a trailing stop loss type conditional order to Sell 1000 AAA shares if the price falls by ‘less than or equal’ to 5% below the previous day’s close. When you enter the order, previous day’s close price is $10.00 so your trailing stop trigger price is $9.50 (i.e. 5% below the previous day’s close price of $10.00).

2. As the AAA share price keeps moving up, your trigger price adjusts accordingly. The stock’s closing price peaks at $15.00 and the calculated trigger price is adjusted to $14.25 (5% below $15.00).

3. The AAA stock then begins to fall and closes the day at $14.50. As this price is lower than the previous day’s closing price of $15.00, your calculated trailing stop trigger price is retained and remains at $14.25.

4. The next day, AAA share price continues to fall and reaches $13.00. As the stock price has now crossed the trigger price of $14.25, your Sell conditional order is triggered and placed into market.

Where you specify a limit price, your triggered sell order will sell at this limit price or higher.

For example, the conditions for your trailing stop loss order are met (with the calculated trigger price at $14.25) but you have set a limit price of $14.30. As your trigger price of $14.25 is below your limit price of $14.30, your Sell order will be placed at $14.30.

Setting trigger conditions: additional optional triggers

Volume trigger

You can choose a specified total volume of stock that must be traded for a stock on a given day. This amount cannot be zero or negative. Your order will only go ahead if this specified volume has been met.

The volume includes On Market trades, adjusted for trade cancellations and excludes Off Market trades.

Time trigger

You can choose a start time so the order will not be trigger prior to this time.

Alternatively, you can choose a finish time so the order will not be triggered after this time.

These triggers are independent of each other, you may solely choose a start or a finish time or use both and prevent your conditional orders from triggering during certain periods for example on market open or market close.

Cross Stock trigger

You can set trigger conditions based on a different stock than the one you wish to buy or sell, i.e. if the last traded price for BHP is ‘greater than or equal to’ $30.65, buy 500 RIO at $2.10.

This is useful when you believe a movement in one stock is closely linked to or will lead to the movement in another stock.

Placing a conditional order

Once trigger conditions are set, you can create your order:

- Choose a stock

- Choose whether to buy or sell

- Choose the quantity you wish to buy or sell

- Choose a limit price – decide on a maximum price to buy or a minimum price to sell your stocks. If your conditional order is triggered but the share price has moved too far above your upper limit price, or too far below your lower limit price, then no order will be placed to market.

Your conditional order only triggers once, i.e. the first time the condition is met.

Please note:

- ‘Limit’ orders can be placed at any time, but can only be executed when the market is open.

- Your conditional order will only be executed if all of your specified trigger conditions are met.

- If your ‘Buy’ limit price is placed higher than the current best sell price, the order will execute at the best sell price currently in the market. Likewise, if your ‘Sell’ limit price is lower than the best buy price, the order will be executed at the best buy price within the market.

How do I activate, track and amend/reset a conditional order?

To activate conditional orders

- Login to your account, activate conditional orders trading in the ‘My account’ tab and agree to the T&Cs.

- Once activated, you can click on the Conditional Order icon in the left-hand toolbar.

To track a conditional order

To view all active and historical conditional orders, go to the ‘Conditional Orders’ section in the ‘Orders’ tab.

From this page, you can opt to view more details on a specific conditional order, check the status, amend and cancel individual or all active conditional orders.

To amend a conditional order

You can amend or cancel an active conditional order at any time.

- Simply go to the ‘Conditional orders’ section in the ‘Orders’ tab where you will see your Open conditional orders

- Find the conditional order you wish to amend and go to ‘order details’ on the right-hand side

- Here you can view, amend or cancel your active conditional order.

To reset a conditional order

You can save time creating a new conditional order by re-using the same settings as an expired order.

- Simply go to the ‘Conditional orders’ section in the ‘Orders’ tab where you will see your conditional order history

- Find the old conditional order you want to reset, then click ‘Reset’ found under the ‘Status’ column. The conditional order pad will display with the same pre-filled fields.

- Review all the trigger conditions and order instructions, then click ‘Confirm’ to create a new conditional order.

How do I know if my conditional order has been triggered?

If your conditional order has been triggered, you will receive an email and SMS (if you have opted for it). You will receive a notification for the following events:

- Placed, amended or cancelled conditional orders

- Triggered conditional orders

- Rejected triggered conditional orders

- Purged conditional orders

You can also check the status of your conditional orders in the ‘Conditional orders’ section in the ‘Orders’ tab in your account.

Please note:

There is no guarantee that a conditional order will be executed following the trigger of all your set conditions. The execution is subject to the successful validation and review by Bell Direct’s operations team and may be rejected where the triggered instruction fails to satisfy our requirements or if you have insufficient stocks or funds to fulfil the order. For more details, please refer to the conditional orders T&Cs.

How much does it cost?

Our conditional order service is FREE.

You will not be charged to place a conditional order and you can amend your active conditional orders as many times as you like at no cost.

Once your triggered conditional order is placed, the standard brokerage fee will apply.

How long is my conditional order valid for?

You can specify a trigger expiry date of up to three months. If the condition is not met within the time period you specify, your conditional order will expire.

Please note:

Your Conditional Order may also be purged earlier before the expiry for various reasons including a corporate action on the stock, change of stock code by ASX, at the request of the ASX or any other third party. For more information about this, go to conditional orders T&Cs.

You will receive an email and SMS notifications (if you have opted for this) to inform you of any expired and purged conditional orders.

Am I able to use my existing margin lending facility with Bell Direct?

You can open a trading account with any margin lender provided you have an active loan facility.

During the sign up process, select the option to have your account to be settled via a margin lending facility.

You’ll then be prompted to select the name of your margin lender and enter details such as your margin loan account number, the name of your account manager and their contact number.

Are there any restrictions on setting up a margin lending account?

Bell Direct will only activate your margin lending trading account after verifying with your margin lender that your margin lending facility is active.

Please note that margin lending trading accounts for superannuation funds cannot be created.

What is an SMSF?

An SMSF is simply a private super fund run by its members. It allows you to take direct control of your super investments, rather than entrusting them to a professional fund manager.

Its purpose is to help you and the other fund members save for retirement, then provide an income for you when you retire.

Because an SMSF is a super fund, it is governed by Australia’s super laws, which set out strict compliance and reporting requirements. Those laws also affect the contributions your fund can accept, the kinds of investments you can make, the paperwork you need to keep, and the way you can access your money. Since it is structured as a trust, each fund also has a trust deed that sets out the rules for your individual fund.

An SMSF can have up to four members, and many SMSFs are run jointly by husbands, wives and other family members. But you can also use an SMSF solely for yourself, especially if you have a large amount of super to invest.

How does an SMSF work?

Each SMSF is run by one or more trustees. You can choose between:

- Individual trustees. If you choose this option, all fund members will be trustees, and all trustees will be fund members. As each fund must have at least two individual trustees, this option is not suitable for single member funds.

- Company trustee. With this option, you appoint a company as trustee, with one or more fund members acting as directors of the company. This structure is often used for single-member funds or funds where a member can’t act as trustee — because they are an overseas resident, for example. It may also be useful for estate planning. However, it does involve extra costs for the set up and administration of the company.

As well as a fund Trust Deed, an SMSF has its own Tax File Number (TFN), Australian Business Number (ABN) and bank account. The members make superannuation contributions to that account, which the trustees then invest on their behalf, following the fund’s documented investment strategy.

Each investment decision needs to be carefully recorded, and there are other reporting and administrative obligations, with penalties for non-compliance. Among other requirements, you need to lodge an annual tax return for your fund and arrange for an annual audit of its financial statements by an approved auditor.

That means you need the time and experience to stay on top of your legislative and reporting obligations — or expert support from a professional administrator.

Is an SMSF right for me?

Each year, more Australians are taking control of their superannuation savings by opening an SMSF. But that doesn’t mean an SMSF is right for everyone.

As an SMSF trustee, you need to take full responsibility for managing your fund’s investments. You also need to create and update a written investment strategy, document investment decisions, keep up to date with legislative changes, and regularly complete large amounts of paperwork.

And while an SMSF can be a highly cost-effective choice for investors with larger super balances, it can be expensive for those with less to invest. That means SMSFs are generally only suitable for active investors who have the time and experience to manage their own investments.

And if you decide to open an SMSF, we can support you with every aspect of setting up and running your new fund — creating a trust deed and investment strategy, applying for an ABN and TFN, and completing all of the regulatory documentation required for full compliance with Australia’s complex super laws.

What are the benefits of an SMSF?

- Direct control of your super. You decide what to invest in, when to buy, when to hold and when to sell.

- A wider choice of investments. By investing through an SMSF, you can access a wider range of investment options than a traditional super fund, including direct shares and property.

- More flexibility. Because you make the decisions, you have the flexibility to design an SMSF strategy that complements your other investments, changing your strategy when new opportunities arise or when your situation changes.

- Potential tax benefits. Super can offer significant tax benefits compared to non-super investments, allowing you to potentially take advantage of more tax-efficient investment strategies.

- Potential cost savings. Provided you have a larger amount of super to invest (typically $200,000 or more), an SMSF could help you save on fees, leaving you with more money to invest.

(APRA, Quarterly Superannuation Performance, March 2013)

What is my role as an SMSF Trustee?

As an SMSF trustee, you’re responsible for every aspect of the fund and its performance, including:

- Ongoing compliance, administration and decision making.

- Staying up to date with SMSF legislation and regulatory requirements.

- Achieving an investment return sufficient to help your members meet their retirement goals.

Super legislation also sets out strict rules for carrying out your obligations as a trustee. As a trustee, you’re required to:

- Act honestly in all matters regarding the fund.

- Display a high degree of care, skill and diligence.

- Act in the best interests of all beneficiaries.

- Keep the money and assets of fund separate from other money and assets.

- Retain control over fund.

- Develop and successfully implement an investment strategy.

- Allow members access to necessary information.

- Behave appropriately and in a manner which does not hinder trustees from perform or utilising their functions or powers.

How do I ensure my SMSF stays compliant?

To stay compliant with super laws, your fund needs to meet a range of tests and ongoing administrative requirements. Here are some of the most important.

Sole purpose test

Your SMSF’s investments must have one purpose and one purpose only: to provide benefits to members upon their retirement (or death benefits, if they die before all of their super has been paid out).

Related party transactions

SMSF funds must not transact with other members, relatives or entities of the fund. There is a limited exception to this rule for SMSFs investing in commercial properties owned by a related party such as a business. But this is a complex area, so professional advice is essential.

In house assets

An in house asset is a loan, investment or lease involving a related party. SMSFs are restricted from lending to or investing more than 5% of the fund’s total asset in an in-house asset. (Again, there are exceptions for business property investments.)

Arm’s length transactions

All of the fund’s transactions must be carried out at arm’s length, with all investments made on a strict commercial basis, reflecting the true market value of each asset.

Borrowings and security

While SMSFs can borrow to invest, there are strict rules about the kinds of loans they can use. Generally, SMSFs can only use limited resource loans secured by individual assets, such as investment properties, so that the lender has no claim over the wider assets of the fund. Again, it’s important to seek professional advice before you borrow.

Investment strategy

As a fund trustee, you must prepare and implement a written investment strategy for your fund. All of your fund’s investments must comply with your strategy, and your strategy must be reviewed regularly to make sure it continues to meet members’ needs.

What are the tax benefits of an SMSF?

Like other super funds, SMSFs can offer significant tax advantages compared to non-super investments.

Here’s a brief summary of some of the potential benefits:

- Concessional super contributions, such as super guarantee contributions, are taxed at just 15%.

- Your SMSF’s investment income is generally taxed at a maximum rate of 15%, while capital gains are taxed at a maximum of 10% where assets have been held for 12 months or more.

- Once you have retired and started receiving a superannuation pension, your fund will generally pay no tax on income generated by your pension account up to the Transfer Balance Cap of $1.6 million. That means you will pay no tax on your investment income or capital gains, and no tax on your pension payments (assuming you are over the age of 60). If your pension account has invested in direct shares, you may even receive a tax refund for franking credits.

But remember — tax laws are complex and everyone’s situation is different. So it’s important to consult your tax adviser before you invest.

What is the mFund settlement service?

mFund is the settlement service provided by ASX to enable investors to buy and sell units in unlisted managed funds directly with fund managers via their Bell Direct trading account.

The service uses CHESS settlement system to automate and track the process of buying (applying for) and selling (redeeming) units in managed funds. Investors’ holdings in these funds are held electronically and can be linked to the same HIN used to hold other investments transacted through ASX, such as shares.

To find out more, download the ASX mFund Brochure and the ASX mFund fact sheet.

How do I invest in managed funds through the mFund service?

Investing in managed funds with mFund is similar to investing in equities. Simply place an order online through our Managed Funds order pad. No need to provide any additional paperwork. Funds will settle through your existing Direct Investment Account.

To invest, follow these 3 steps:

- You can either login to your account and research mFund products from the Managed Funds page, read the fund profile and the PDS; or to search by asset class, sector or other attributes, visit the ASX mFund page.

- When you’re ready to invest, choose the ‘Managed Funds’ option on the Order Pad and place your order online.

- Your new mFund units are transferred to your CHESS holdings and you’ll see them in your portfolio.

To sell your managed funds units, go to the Managed Funds order pad, choose the ‘Sell’ option and enter the quantity you plan to sell.

How much does it cost?

- For trades placed on Bell Direct website, the brokerage is $30 or 0.1%, whichever is greater

- For trades placed over the phone, the brokerage is $60 or 0.2%, whichever is greater

What is an exchange traded option?

An exchange traded option (ETO) is a contract that gives you the opportunity to profit from movements in the price of an underlying security, such as a share or index. ETOs are publicly traded on the ASX.

What's the difference between a put and a call?

If you’re trading equity options, a call gives you the right, but not the obligation, to buy a parcel of shares for a pre-determined exercise price on or before a pre-determined expiry date. A put is similar, except it gives you the right to sell the shares, rather than buy them.

If you’re trading index options, you receive a cash payment if the underlying index has reached the exercise level on the expiry date. A call option pays if the index has climbed above the exercise level, while a put option pays if the index has fallen below that level.

What are the risks?

ETOs are generally considered risky investments for experienced traders. The risks of trading ETOs include:

- Time decay: ETOs tend to lose value as they approach their expiry date and they are worthless after they expire. That means you could lose your entire investment even if your view of the underlying security later proves correct.

- Leverage: because ETOs cost a fraction of the price of the underlying security, they are highly leveraged. Leverage multiplies your profits when the market moves in your favour, but it can also multiply your losses.

- Writing options: if you decide to write options, rather than simply trading options written by others, you can face potentially unlimited losses. For example, if you write an equity call option, you give someone else the right to buy the underlying shares from you at a fixed price, no matter how high those shares have climbed by the expiry date. Currently, writing options is not available through Bell Direct.

How are ETOs different from Warrants?

Like warrants, ETOs give you exposure to changes in the price of an underlying security without buying that security directly. But unlike warrants:

- ETOs have standardised terms set by the ASX, rather than the individual issuer. For example, equity option contracts are always written for parcels of 100 shares (and sometimes the possibility of corporate actions can affect the contract size), while warrants can be for any number of shares, depending on the terms set by the issuer.

- ETOs can be written by anyone, while warrants can only be issued by an approved warrant issuer, usually a bank.

- ETOs can be short sold.

How do I get a quote for an ETO series?

If you know the ASX code for the series, simply log on to Bell Direct, then enter the code in the Quote field at the top left of each page and press Enter.

On the Quotes & news menu, click Exchange traded options.

In the Search for ETO Codes list, select the three-letter ASX code for the underlying share or index, then click Display. All ETO series for that share or index are displayed.

Click on a series to view more details.

What strategies can I use?

Right now, you can use our ETO trading service to open and close long positions.

Can I write options through Bell Direct?

Not right now.

When is the ETO market open for trading?

| Phase | Time |

|---|---|

| Pre-open | 7am - 10am AEST |

| Normal trading | 10am - 4pm AEST |

| Extended normal trading (without market maker obligations) | 4pm - 4.20pm AEST |

Can I place ETO orders outside market hours?

Yes, you can place limit orders outside market hours. ETO orders received after market close (currently 4.20pm (AEST) will be placed on market the following trading day and will be valid for that trading day only.

How quickly will my order go to market?

If you place an ETO order online during market hours, then as long as it passes our filter it will be placed directly on market. If you place an order outside market hours or it is caught by our filter, it will be processed by our options traders as quickly as possible.

How much does it cost?

Our brokerage and exercise fees are listed on the fees page.

As well as our brokerage, you will need to pay ASX Clear fees. Go to the fees page and look in the Fee tiers section for more details.

Because ETO orders are good for the day only, you may need to place a second order if your first order is only partially filled (that is, not fully completed at the end of the day). If that happens, you will need to pay brokerage for your new order.

How do I exercise an option?

If your option expires in-the-money, we will automatically exercise it for you. If you don’t want us to exercise an in-the-money option, please call us on 1300 786 199 before 4:00 pm (AEST) on the expiry date.

If you wish to exercise an option before expiry, simply call us on 1300 786 199.

What is open interest?

Open interest (OI) in an options series is the total number of outstanding contracts in that series. Open interest increases when a buyer buys to open or a seller sells to open. Open interest falls if both buyer and seller close their positions. It remains the same if one party to a transaction is opening a position while the other is closing theirs.

If an equity option is in the money, you can calculate the number of underlying shares that will be exercised or assigned by multiplying the open interest on the expiry date by the contract size.

The ASX releases new figures for open interest at the end of each trading day.

What is the put/call ratio?

The put/call ratio is an important indicator of market sentiment and the possible future direction of the market. It is calculated by dividing total number of put options traded over a particular security and dividing it by the number of calls traded over the same security.

A ratio over one means that more puts than calls have traded during the day, possibly indicating a bearish market for the underlying security and its options. A ratio under one means that calls are more popular than puts, potentially indicating a bullish market.

This ratio is updated live as trades occur during the day. A second ratio, the put/call OI ratio, is also calculated at the end of each trading day, using the open interest for puts and calls over the security. You can view both ratios by searching for an underlying security on the ETO page.

Where can I learn more about ETOs?

You can learn more about ETOs on the ASX website or by reading these educational booklets:

Can’t see the answer you’re looking for below? Call our client support team on 1300 786 199.

How do I open an international trading account?

To open an international trading account with Bell Direct, you first require a Bell Direct Australian shares trading account.

Opening your account is easy – check our the instruction guide or watch our demo video now.

Download our instruction guide (PDF) here.

Watch the demo video here:

Who can create an international trading account?

Bell Direct clients with an individual trading account who use the Bell Financial Trust settlement.

International trading for other account types are on the way!

My international account is pending. What do I need to do next?

Don’t worry, our partner DriveWealth must ensure they have enough details to perform their “Know Your Client” obligations. They may need some more details, so we’ll be in touch shortly to obtain whatever is outstanding (usually a copy of your passport or drivers’ license).

You have 30 days to give us the information. In the meantime, you can transfer money to USD and trade on your account. However, if you do not provide the required information within the 30 days your account will be frozen.

Who provides the international trading service?

Bell Direct has partnered with DriveWealth LLC, a US registered broker dealer, to provide the international trading service. Please review the documents in the attached DriveWealth Agreements and Disclosures.

How safe are my investments through DriveWealth?

We take your security very seriously.

DriveWealth is a member of the Securities Investor Protection Corporations (SIPC), which protects the Securities and funds in your US brokerage account with DriveWealth. Your investments are covered by SIPC up to US$500,000, including up to US$250,000 protection for cash in your account to buy securities. SIPC protection is only available in the event that DriveWealth fails. SIPC does not protect against a loss in the market value of your US Securities.

What can I trade on an international trading account?

Initially you can trade securities listed on the US exchanges including equities, exchange traded funds (ETFs), exchange traded notes (ETN) and approved depository receipts (ADR).

We plan to expand your access to other markets in the future.

Do I earn interest on my US funds?

Any of your US dollars not required for settlement are invested into the Dreyfus Treasury Securities Cash Management Fund. You will receive a monthly pro-rata dividend based on the amount and duration each month.

Your investment is in ticker code DARXX, which is the Administrative Shares Class of the Dreyfus Treasury Securities Cash Management Fund.

How do I transfer funds to USD so I can trade?

To transfer funds to USD, first create your International Trading Account and make sure you have sufficient Australian dollars in your Bell Financial Trust account. See how to deposit and withdraw funds for more details.

When your account is created, follow these 5 steps:

Step 1: Make sure you have at least the equivalent of $300USD (that is the minimum amount).

Step 2: Go to the Funds Transfer screen. There are links to the Funds transfer screen in a number of placed on the website, just look for the Transfer Currency link, or choose Funds transfer from the My account menu.

Step 3: Select the International Transfer tab. On the right hand side of the screen you can see your AUD Avail Transfer Funds and your USD Available to Trade and Withdraw.

Step 4: Make sure the Send box contains the Australian flag and AUD, and the Receive box the US flag and USD.

Enter the amount you would like to send or receive, hit the tab key, and the system will calculate the other currency based on the FX rate on the screen. Click next.

Step 5: Enter your PIN and then Confirm.

You’re ready. you will be able to trade immediately on the USD that you transferred.

How do I withdraw USD and convert to AUD?

Step 1: First, check your USD Available to Withdraw on the Order Pad, the Portfolio screen or the Transfer screen.

Step 2: Go to the Funds transfer screen.

There are links to the Funds transfer screen in a number of places on the website, just look for the Transfer Currency link, or choose Funds transfer from the My account menu.

Step 3: Select the International Transfer tab. On the right hand side of the screen you can see your AUD Avail Transfer Funds and your USD Available to Trade and Withdraw. Ensure the Send box contains the Australian flag and AUD, and the Receive box the US Flag and USD.

Step 4: Enter the amount you would like to send or receive, hit the tab key, and the system will calculate the other currency based on the FX rate on the screen. Click Next.

Step 5: Enter your PIN and then Confirm.

You’ll be able to trade immediately on the domestic market. Funds will usually be available to withdraw to your nominated external bank account within one business day.

How do I place an order?

You can place an order on the same screen as the domestic market. Either click on the trade icon on the left hand side of the screen or the buy and sell buttons you see on your portfolio or the quote page.

For a buy order check on the right hand side of the screen -US Available Funds, Available to trade that you have sufficient funds to place your order.

For a sell order, the number of units you have available to sell will default into the Quantity field.

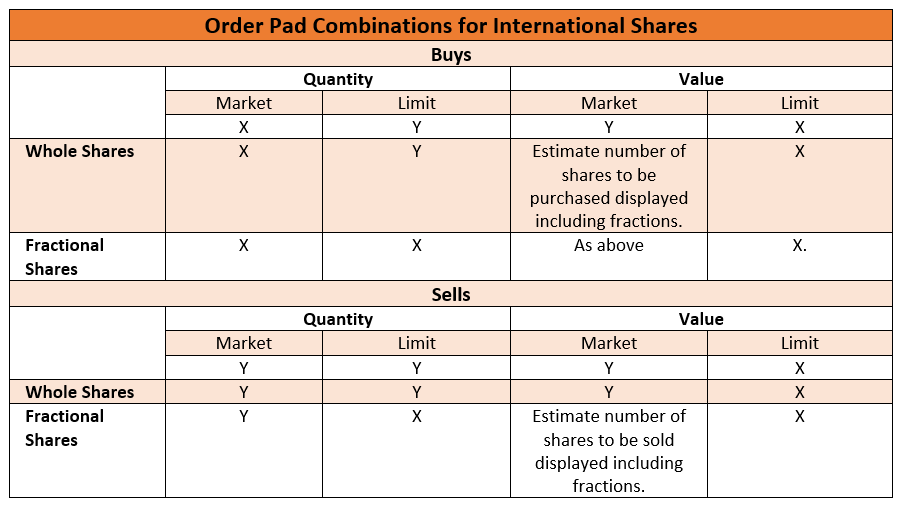

Unlike many other brokers, you can purchase fractions of international shares with Bell Direct. Enter the the amount you wish to invest in the Value field, click Market and then Next. You will see an estimate of the number of shares, including fractions, that you will purchase. (This is an estimate only based on the last available price. It may change, especially if placing your order out of the market hours).

Check out the various combinations that apply for international trading on the order pad.

What are the minimum trade and transfer amounts?

The minimum amount you can transfer from AUD to USD is the equivalent of $300USD.

The minimum buy amount on any international share trade is $300USD.

What is the FX Rate?

The FX (foreign exchange) rate is displayed at the top of each screen. You will see an AUD to USD rate, and a USD to AUD rate. On the fund transfer screen you will also see the applicable rate for your transaction which will match the rates at the top of each screen.

Bell Direct takes a margin of 60 basis points on any FX transaction. For example, if you transfer $10,000 AUD to USD our margin will be $60USD, or if you transfer the equivalent of $10,000 AUD from USD then the margin will also be $60USD. This rate is highly competitive with other similar brokers.

How much is brokerage?

As a special introductory offer, until the end of August 2024 brokerage will zero. From 1 September 2024 brokerage will be $10USD or 0.1% whichever is the highest. Note GST is not applied to international brokerage.

Are US prices delayed or real time?

All prices are in real time. Click to refresh the prices if you want the latest prices.

Where is my US tax documentation (W8BEN)?

If you would like a copy of your W8BEN or W9BEN then please contact us on 1300 786 199 or support@belldirect.com.au

How do I transfer shares into my international account?

If you have existing holdings with another broker, for now we are not able to transfer the holdings into your account.

This is a feature we will develop in the future – stay tuned.

How do I cancel, view or amend an order?

The process to view and cancel an order is the same as the domestic market.

Navigate to the Order tab at the top of the page, select Orders and scroll down to International Open Orders. Click on the cancel or view icons displayed under Details.

To cancel enter your PIN and confirm.

It is not possible to amend an International order. If you want to change it, cancel the order and place it again with the amended values.

Why is it international trading if it is only US shares?

We’re starting with US shares, with plans to add other markets down the track as demand increases. Our research shows that US markets make up the majority of what investors want and currently trade in Australia.

I was notified via email for a corporate action

You will be notified by email of any corporate action that you need to respond to. Simply follow the instructions in the email.

Can’t see the answer you’re looking for below? Call our client support team on 1300 786 199.

I’M READY

I’M THINKING ABOUT IT