JOIN NOW – OFFER ENDS SOON

Looking for confidence in an uncertain world?

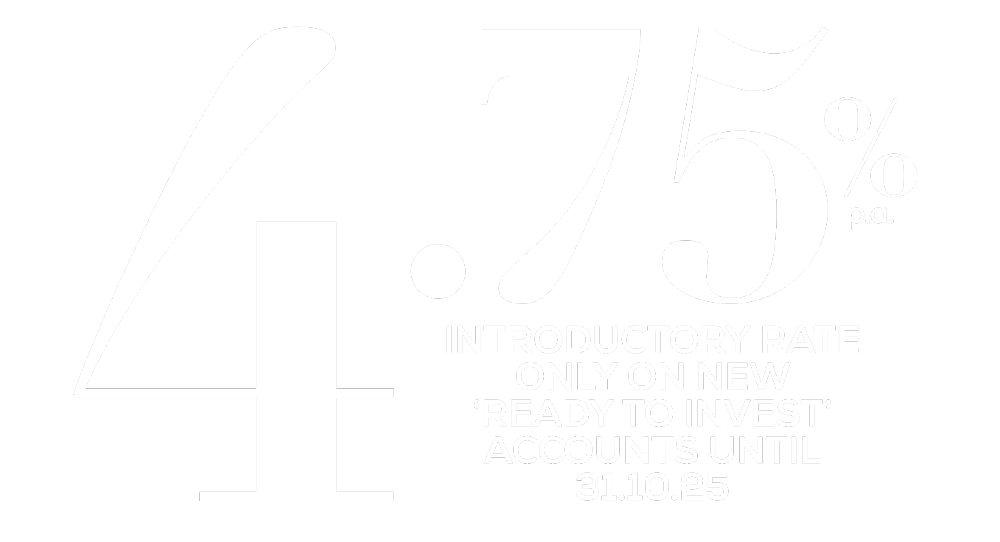

Take advantage of a 4.75% p.a. variable interest rate and produce competitive returns while you’re on the lookout for your next investment opportunity.

Don’t miss out though – this offer is ending soon. Apply today to make sure you take advantage of this great rate, which is only running until 31.10.25.

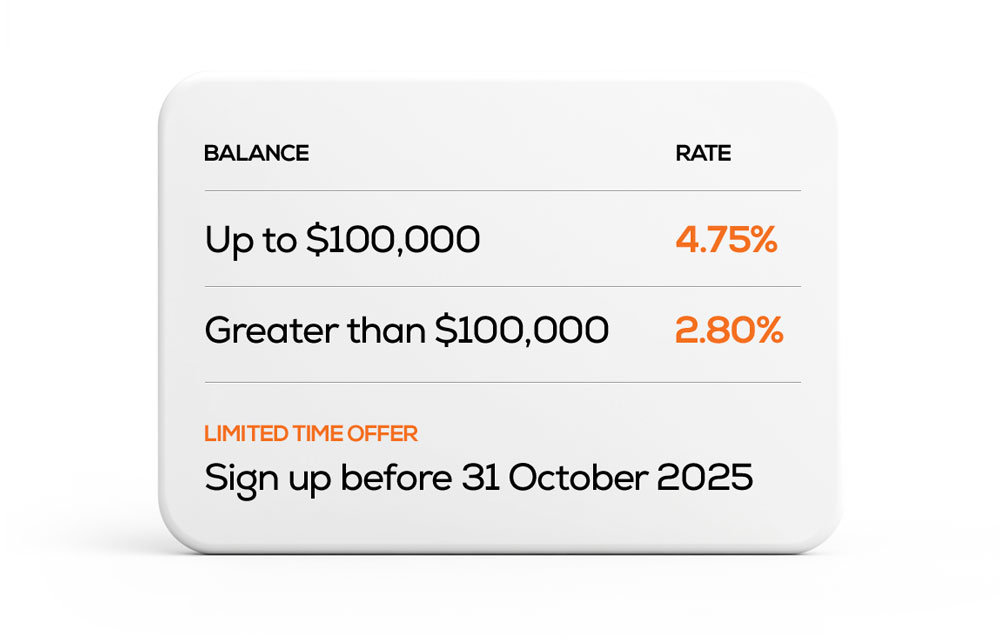

Earn a variable interest rate of 4.75% on balances up to $100,000. Balances greater than $100,000 will earn a variable interest rate of 2.80% p.a. on the full balance of your Direct Investment Account. Rates are subject to change and conditions apply [i].

Transfer your stocks before 31.10.2025 and get a $300 brokerage credit

When you’re ready to trade on the Aussie and US stock markets, you’ll enjoy brokerage worth $300 – on us. Brokerage credit valid until 31/12/2025.

Stay in the know

In fast-moving markets, the best way to identify investment opportunities is to keep up to date with the latest market research and analysis.

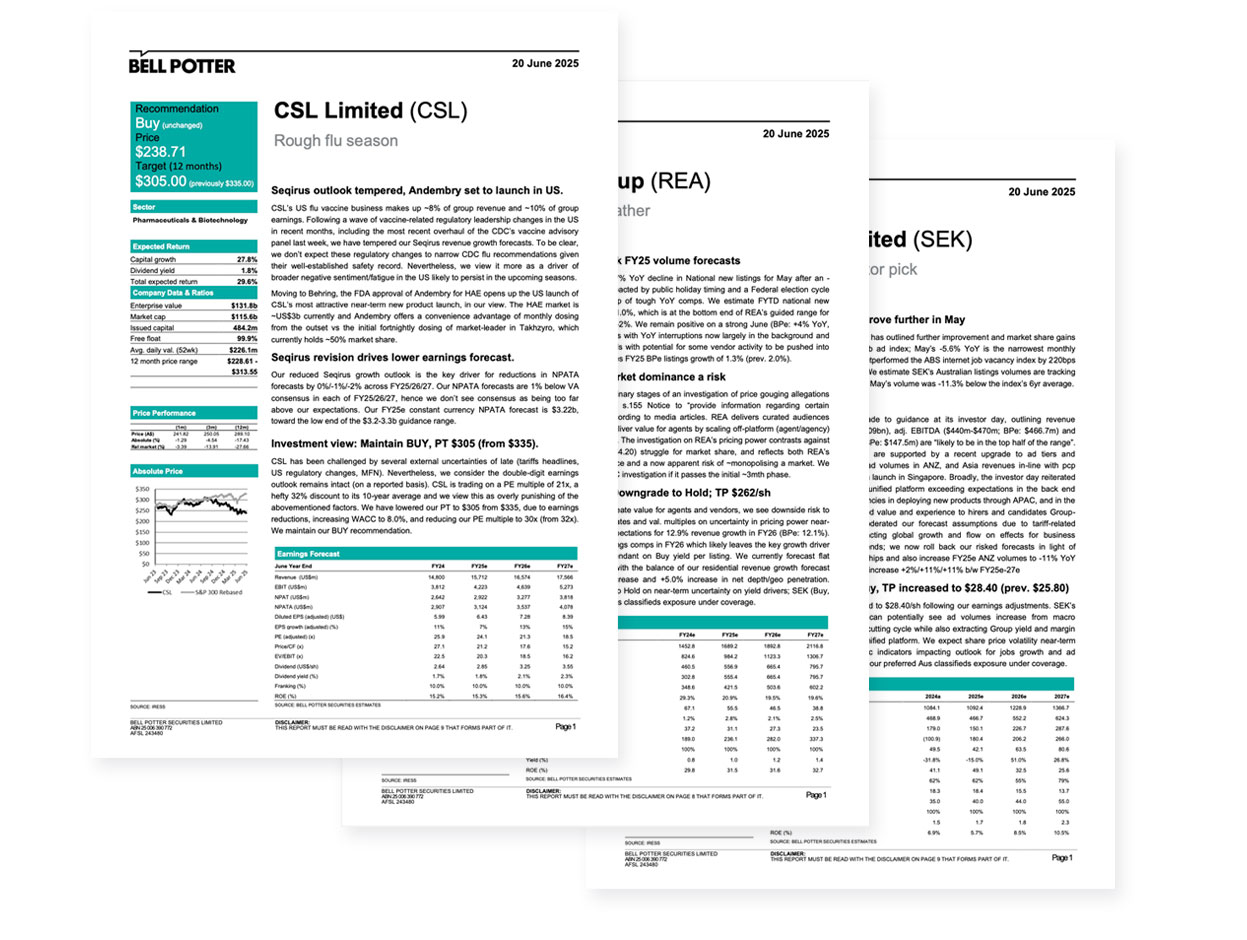

You’ll get exclusive analyst recommendations on a huge selection of ASX-listed companies to help you make informed investment decisions, including:

- stock recommendations and price targets

- earnings forecasts and estimate changes

- financial analyses and valuations

- comparisons with peers

- results previews and reviews.

Exclusive knowledge gives you the power to act fast when you see a new opportunity.

With Bell Direct, you get the tools to thrive

Tools and research to help experienced investors get ahead

Award-winning customer service and your calls answered, on average, within 20 seconds

A secure, reliable investment platform

An Australian-owned platform backed by Bell Financial Group

Value for money

Legal ownership of your shares, with your own individual HIN

Access to Aussie and US stock markets

Mobile trading

Find your investing edge

Bell Direct is the ultimate investment platform, ranked #1 for overall satisfaction by investors with 10+ years’ experience.

When you place your first trade with us you access Bell Potter research – premium insights that you can’t get from any other broker.

Uncertain times?

Make sure your trading platform is secure

We’re part of the Bell Financial Group, which has over 860 employees operating across 13 offices in Australia, as well as offices in New York, London, Hong Kong and Kuala Lumpur.

Your shares belong to you.

When you join Bell Direct, you’ll get or use your own individual HIN, so you have legal ownership of the shares you buy – no questions asked, and no asterisks.

That’s more secure than many of the newer ‘low-cost’ broker platforms, which operate under a custodial or nominee model that pools everyone’s shares – and sometimes cash – together. This means investors do not have legal ownership over their shares. In the event of bankruptcy, or collapse of the platform, investors have limited claim to their shares.

Terms of the introductory offer.

1. Who is eligible for this offer?

Bell Direct Trading accounts opened after 13 July 2025 with a linked Direct Investment Account will also receive our introductory variable interest rates until 31 October 2025.

Offer for new Bell Direct accounts settling via the Direct Investment Account (formally named the Bell Financial Trust ARSN 164 391 119). For more further information on the Direct Investment account, including details on the potential benefits and risks, read the Product Disclosure Statement and Additional Information and Target Market Determination.

This information is general only. Please consider the terms and conditions, Product Disclosure Statement and TMD and appropriateness for your personal circumstances prior to investing.

The Direct Investment Account is a managed investment scheme and is not a bank account offered by an ADI.

2. When does this offer start and close?

This offer runs from 13 July 2025 to 31 October 2025 for new Bell Direct accounts with a linked Direct Investment Account.

3. What is my introductory interest rate?

Bell Direct accounts opened after 13 July 2025 with a linked Direct Investment Account will receive our introductory variable interest rates until 31 October 2025.

Introductory interest rates are subject to change, and you can visit this website for the applicable variable interest rates. The current introductory interest rates are:

Balances up to $100,000 will earn a variable interest rate of 4.75% p.a.

Balances greater than $100,000, a variable interest rate of 2.80% p.a. will apply to the full balance of the Direct Investment Account.

Interest income is calculated daily and added to your account balance monthly in arrears. At the end of the introductory period, your Direct Investment Account will be the standard advertised interest rates.

4. How soon can I start trading after opening an account?

You can generally start trading within:

- 3 working days if you have applied for a new holder identification number (HIN) for your trading account

- 4 working days if you have requested for a HIN transfer across from your previous broker to your trading account.

We will contact you if you require any further information on your application.

When your trading account is active, you can deposit funds into your Direct Investment Account and start trading.

5. What do I need to set up an account?

You need:

- your ID details so we can verify your identity online (i.e. Australian passport or driver’s license)

- your bank account details (from an Australian bank)

- Tax File Number (optional)

- company or trust documents if you are opening an SMSF, company or trust account

- your HIN if you’re switching from another broker.

6. How do I access the Bell Potter research reports?

Login to your Bell Direct account. Select “Research and Tools”, then “Bell Potter research”.

7. When will I start receiving the introductory interest rate offer?

Bell Direct accounts opened after 13 July June 2025 will start receiving the introductory interest rate offer when the trading account is active and linked to the Direct Investment Account will receive our introductory variable interest rates until 31 October 2025. Balances up to $100,000 will earn variable interest rate of 4.75%p.a. Balances greater than $100,000, a variable interest rate of 2.80% p.a. will apply to the full balance. Interest is calculated daily and added to your account balance monthly in arrears. At the end of the introductory period, your Direct Investment Account will be the advertised interest rates.

8. How do I deposit funds to start trading and withdraw funds from my account?

Watch our instructional video above, or follow the steps below:

Deposit funds into your Direct Investment Account electronically by either:

- BPay: simply use the Biller Code and your BPay Reference

- Electronic transfer: use your BSB and Account Number

To find your deposit details:

- Click on the “My account” tab underneath the “My account” drop down button (this is in the top right of your page)

- Scroll to the bottom of the page and you will see your ‘Trading account Information’.

- On the left hand side you can view the BPay Biller Code and Reference number as well as the BSB and Account Number for the Electronic Funds Transfer.

- Use either of these to fund your Direct Investment Account.

Remember: You must deposit funds into your trading account first, then you can start trading.

The timing of your funds deposit reaching your Direct Investment Account depend on your bank’s processing time.

If your deposit instruction was completed before your bank’s cut-off time, your funds will usually be in your Direct Investment Account the next business day. If your deposit instruction was completed after your bank’s cut-off time, your funds will normally be in your Direct Investment Account the following business day.

To withdraw funds simply:

- Click on the “Fund transfers” tab underneath the “My account” drop down button (this is in the top right of your page)

- Or, within your trading account information (under “My account” in step 1 of finding your deposit details), click on “transfer funds out”.

- Then, just follow the steps, and submit a funds transfer request online anytime from your Direct Investment Account to your nominated bank account.

- Enter your trading PIN to complete the fund transfer request.

Available to transfer balance takes into account your Direct Investment Account balance and any buys pending settlement and open buy orders you have at the time of processing your transfer request. If you have sell orders that are due for settlement, you will only be able to transfer the funds out after the sell orders settle (T+2, between 12pm to 5pm AEST).

When you submit your transfer request before 2:30pm AEDT on business days, your funds transfer is processed on the same day and the funds should be in your nominated bank account the next working day.

After 2:30pm AEDT on a business day or on a non-business day, your instruction will be processed at 2:30pm the next business day.

The cut-off on non-settlement days and shortened ASX trading days such as Christmas Eve and New Year’s Eve is 12.30pm AEDT.

9. How do I transfer by holdings to Bell Direct?

To transfer shares to your Bell Direct account, follow these steps:

- Determine where the shares are held: at another broker or at a share registry.

- Complete the correct transfer request form:

For shares from another broker:

- Login and go to Forms in the My Account tab

- Complete the Broker to Broker Transfer Request form.

Remember, your details at the other broker must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, complete an Off Market Transfer Request form (found in Forms in the My Account tab once logged in) (at a cost of $55 per holding).

- For shares from a share registry:

- Login go to Forms in the My Account tab

Complete the Issuer Sponsored Conversion Request form.

Remember, your details at the share registry must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, contact the share registry to change the details before submitting the Issuer Sponsored Conversion Request form.

You can find all the request forms on your My account tab once you have logged in.

Good news – if you’re in the process of opening a new online share trading account with us, you will have the option to transfer a HIN across during the online account setup process.

- Send us your signed request form by:

- Email at support@belldirect.com.au

- Mail to Bell Direct, GPO Box 1630, Sydney NSW 2001

Once we’ve received it, we’ll transfer the shares into your Bell Direct account within 3 days.

Join Bell Direct Now

Start earning 4.75% on your linked account

[i] Bell Direct accounts opened after 13 July 2025 with a linked Direct Investment Account will receive our introductory variable interest rates until 31 October 2025. Balances up to $100,000 will earn a variable interest rate of 4.75% p.a. Balances greater than $100,000 will earn a variable interest rate of 2.80% p.a. on the full balance of your Direct Investment Account. Interest is calculated daily and added to your account balance monthly in arrears. At the end of the introductory period, your Direct Investment Account will be the advertised interest rates.

Full terms & applicable interest rates after the introductory offer expires 31.10.25 at belldirect.com.au. Offer for new Bell Direct accounts settling via the Direct Investment Account (formally named the Bell Financial Trust ARSN 164 391 119). This information is general only and does not take into account your objectives, financial situation or needs. The Trust Company (RE Services) Limited (ABN 45 003 278 831, AFSL 235150) is the issuer of the Bell Financial Trust. Please consider the PDS, terms and conditions and appropriateness for your personal circumstances prior to investing. The PDS and TMD for the Bell Financial Trust are available at belldirect.com.au. Bell Direct is Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.

Bell Direct ranked #1 for overall satisfaction, customer service, help in identifying opportunities, stock comparison/selection tools, education materials/programs and reporting. As voted by investors with 10+ years’ experience in the 1H 2023 Investment Trends Online Investing Survey.