When it comes to investing, Australians have a significant bias towards large cap Australian shares, despite the benefits offered by diversifying to different sectors and regions.

In the first half of 2020, as indices worldwide were battered by uncertainty, Australian investors retained this home bias and many investors increased their domestic bias even further, by buying up local shares and Exchange Traded Funds (ETFs), perhaps driven by their desire to invest in the familiar amid the uncertainty.

To recap, ETFs are managed funds that are traded on an exchange, similar to individual shares. Each ETF typically invests in a basket of shares that track an index, such as the S&P/ASX200, which represents the 200 largest companies on the Australian Securities Exchange (ASX).

The home bias of local investors is unsurprising, given Australia’s swift and effective response to containing and managing the pandemic and the policy measures from the government and the RBA, which were deployed quickly and aggressively.

However, while Australia’s recession has been relatively mild in comparison to regions such as the U.S. and Europe, our share market performance did not reflect this, with the Australian market lagging since the global market recovery began in April. As at 25 August, the S&P500, which tracks the largest companies in the U.S., was up 54% since the COVID-19 market low. In comparison, the ASX300 was only up 36% over the same time frame. This shows the dislocation that can occur between share markets and economies and the importance of taking a diversified approach to investing.

Discover new markets

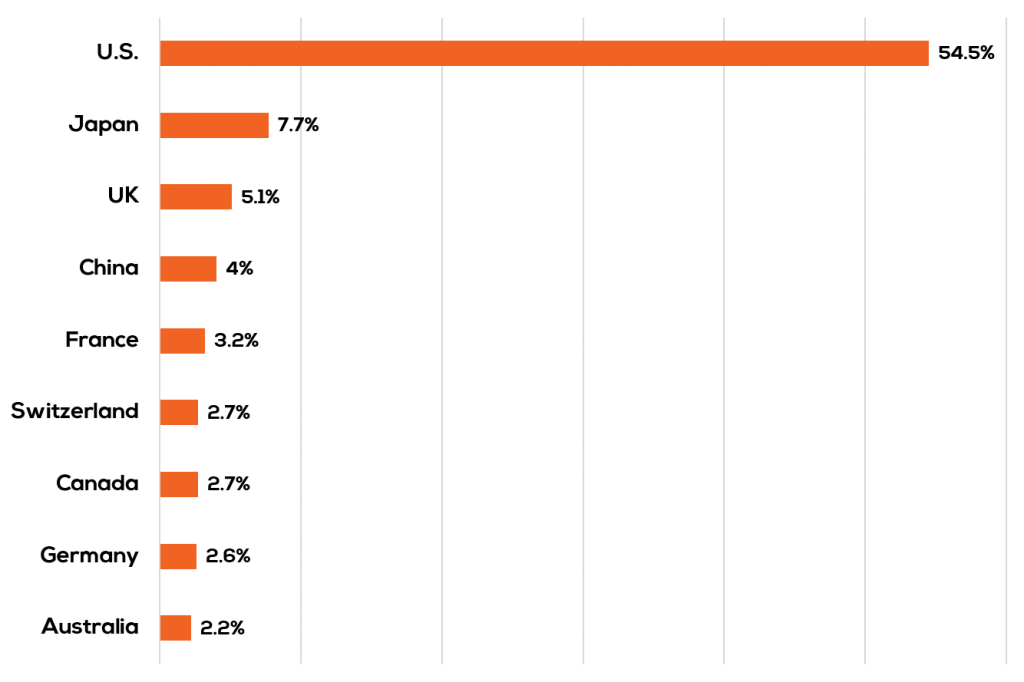

When constructing or revisiting your portfolio, it is important to note that Australia’s economy makes up only 2% of the global market. As shown in the following chart, when looking at the combined value of all global stock markets, the Australian market is dwarfed by the U.S. (which makes up over half), along with Japan, the UK and China.

Countries with the largest stock markets worldwide (Jan 2020)

Australia’s stock market also looks much the same as it did 10 years ago, with financial organisations and resources companies making up almost half (44.5%) of the ASX300.

As a result, it is important to look offshore to construct a fully diversified portfolio across the major asset classes.

A popular way to do this is via ETFs, which offer a simple and easy way to invest in a portfolio of international shares.

Rather than spending time buying and reviewing multiple stocks, you can buy a single international ETF that gives access to tens, hundreds or thousands of stocks in one ASX trade. Investors can invest in a specific country, such as the U.S., Japan or the UK, via dedicated ETFs which track the respective local share market. Another option is to invest in a fully diversified global ETF which doesn’t include Australia, such as the SPDR S&P World ex Australia Fund (ASX:WXOZ).

Tap into specific investment themes

In addition to investing offshore, another popular way to diversify and tap into growth potential is by exploring specific sectors such as healthcare and technology.

The global healthcare sector has attracted more attention during the race to uncover a vaccine for COVID-19. The sector is also benefiting from longer term trends, which include the growth of the telehealth sector in the U.S., an ageing global population and the emerging middle class in Asia. Some examples of ETFs that target this space are BetaShares’ (ASX:DRUG) and iShares’ (ASX:IXJ).

The technology sector is also growing at a rapid rate, only accelerated by the uptick in technology use this year following the COVID-19 outbreak. For those seeking broad exposure, Morningstar’s global technology ETF (ASX:TECH) tracks technology businesses that have a competitive advantage over others in the same field, while BetaShares offers a fund (ASX:NDQ) that tracks the largest 100 stocks on the U.S. NASDAQ exchange, which includes companies such as Apple, Facebook and Netflix.

There are also now ETFs that enable investment in Asia’s growing tech sector. Vanguard’s Asian Share ETF (ASX:VAE) is heavily dominated by technology businesses and in 2018 BetaShares launched its Asian Technology Tigers ETF (ASX:ASIA) to allow investors to tap into this market.

The technology sector is now so big that investors can also invest in specific subsectors that tap into megatrends, such as cybersecurity, artificial intelligence and robotics. Take a look at BetaShares’ dedicated ETFs which cover these emerging investment themes: (ASX:HACK), (ASX:RBTZ) and (ASX:ROBO).

The initial volatility caused by the COVID-19 pandemic resulted in many investors seeking stability in the local market. However, as the focus shifts, the opportunities on offer in global markets and specific sectors should not be ignored and ETFs are a simple way to gain exposure.

For a limited time, you can join Bell Direct and trade ETFs with no brokerage costs. This special offer is only available until 30 September, so click here and take advantage while you still can.