With global economic growth vulnerable to a Donald Trump tweet stoking trade hostility and losses to the property market earlier in the year, one could forgive the cautious among us opting to hide gold bullion under the bed.

And in the billion-dollar field of investing for high-growth return, this answer isn’t too far from the truth.

Over the last 10 years, gold miner Northern Star (NST) has been a standout performer on the Australian securities exchange.

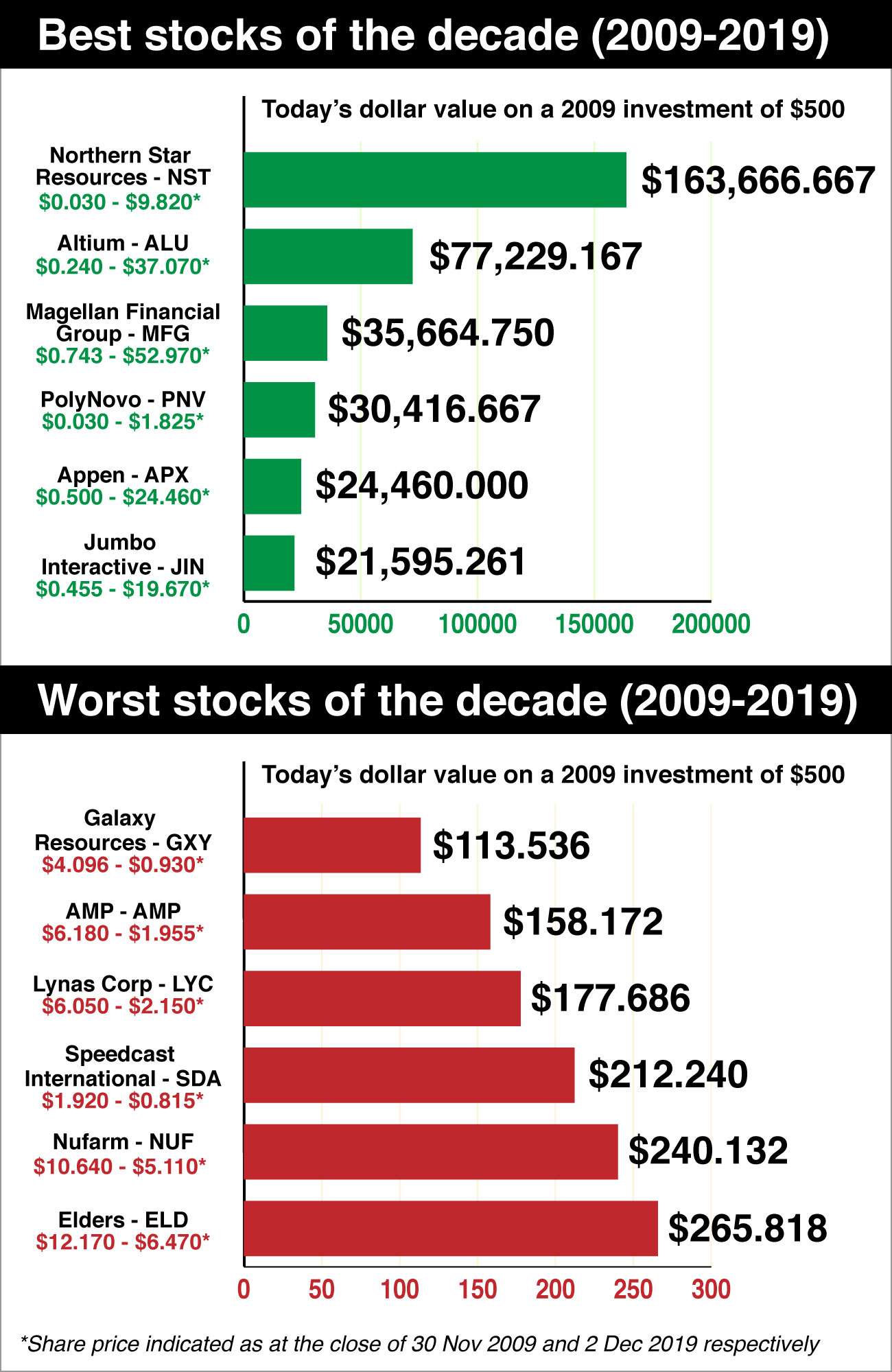

Shares in the resource company were worth just 3 cents at the end of November in 2009 but surged nearly 33,000 per cent to early December 2019, according to data collected by Bell Direct.

An investment of just $500 at the start of this period would have provided a whopping return of nearly $164,000.

“They’ve seen some monumental gains,” Bell Direct market analyst Jess Amir told news.com.au.

The gold miner has a market cap of more than $8 billion after acquiring several operations in Western Australia and North America.

In December it bought into the Kalgoorlie Super Pit, the largest open gold mine in Australia, while its executive chairman told investors in October the company was pushing ahead with its Pogo operation in Alaska.

“They’ve also had a record year for growth and they’ve been growing their earnings,” Ms Amir said.

Northern Star’s growth was more than double that of the next best, but the top six performing companies also pocketed significant returns.

Behind the gold miner was the electronic circuit board producer Altium (ALU), which jumped more than 15,000 per cent from 24 cents to more than $37.

A $500 investment would now be worth more than $76,700.

A key member of Australia’s group of high-performing tech companies dubbed WAAAX – Wisetech, Altium, Appen, Afterpay and Xero – it has deals with some of the world’s largest companies and institutions including Microsoft and NASA.

And while many of the decade’s stocks to record high growth have likely hit their ceilings, Ms Amir says Altium’s recent push into China may continue to prove profitable for investors.

“This one has shot the lights out the most of the WAAAX companies,” she said. “It’s a standout over 10 years.”

Investment firm Magellan’s (MFG) share price leapt from more than 74 cents to nearly $53 over the decade, a jump of more than 7000 per cent.

“In the investment world, they’re going against the grain and they’re seeing lots of growth of funds under management,” Ms Amir told news.com.au.

The firm continued to grow right through to December after it reported a boost to its net inflows, and its total funds under management rocketed to nearly $98 billion.

Tech company Appen (APX) and lottery gamer Jumbo Interactive (JIN) climbed nearly 4800 and more than 4200 per cent respectively over the 10 years, but Polynovo (PNV) is a particularly interesting company.

It’s another that surged from just 3 cents, but the medical device company only launched on the ASX in 2015 and has gained nearly 6000 per cent since.

An investor’s original outlay of $500 would now be worth more than $29,900 from the company that helps victims with horrific burns and general accident injuries.

“If you invested in them you’ve not only made a handsome return but they’re also helping people,” Ms Amir said.

WORST STOCKS OF THE DECADE

The six biggest losers in share price value over the 10 years is a dirty laundry list of underperforming companies joined by AMP.

The once institutional wealth manager has spiralled lower and lower after its fees-for-no-service scandal emerged during the financial royal commission in 2018.

AMP began the decade at more than $6 but lost 68 per cent to be less than $2 in December.

Ms Amir, however, focused on two of the underperforming companies as sources of potential future growth.

Lithium miner Galaxy Resources (GXY) suffered the heaviest losses to its share price over the decade, falling 77 per cent from more than $4 to just 93 cents based on the volatility of the chemical element’s value.

“The lithium price made headlines two years ago in 2017 when its stocks were the talk of the town and they were the market darlings,” the Bell Direct market analyst said.

“They’ve lost their shine this year because the lithium price took a hit, but we think this company should ride out the lithium market weakness.”

The demand for the chemical element is expected to grow as environmentally conscious consumers increasingly turn to electric cars coupled with the ubiquitous reach of mobile phones that rely on batteries made from lithium.

The other stock to watch is Elders (ELD).

Source: News Regional Media

The agribusiness’s share price lost 47 per cent to $6.47, but Ms Amir expects it to construct a “massive turnaround” in 2020.

“Already in 2019, this has proved to be a resilient company because it reported profit that beat expectations despite the drought being the worst we’ve seen in 100 years,” she said.

Elders will also gain from improving demand for crop protection such as fertilisers as well as profiting from the high demand for Australian cattle in China.

WHERE TO MAKE MONEY IN 2020

HEALTHCARE

The healthcare sector has already been an engine room for the ASX, particularly through market darlings CSL and Cochlear (COH).

Ms Amir says the country’s ageing population will only increase the potential value of the sector.

“Regardless of what’s going on in the economy, people will always have a healthcare need,” she said.

A good option for novice investors is to consider the whole sector to help diversify their risks through an exchange traded fund.

INFRASTRUCTURE

The prevailing view among economists and financial commentators is the Reserve Bank will cut interest rates twice in 2020 but appears unwilling to go further.

This means the Federal Government will need to step in and contribute stimulus of its own, which will likely come in the form of boosting infrastructure spending.

Therefore, Ms Amir says investors should look at companies that focus on rail and road projects in the new year as well as utilities.

“Infrastructure stocks and contracting companies in infrastructure are likely to do well,” she said.

A key beneficiary of this looming fiscal policy will be toll road constructor and operator Transurban (TCL).

This article was first published on news.com.au.